If you need a super dedicated, intelligent REALTOR® in the East Valley (Chandler, Mesa, etc) or Verde Valley (Sedona, Cottonwood, etc) area to help you along your home buying journey, please call or text Becky Crockett at (480) 467-9268 or email becky@vizualifeaz.com

If you need a super dedicated, intelligent REALTOR® in the East Valley (Chandler, Mesa, etc) or Verde Valley (Sedona, Cottonwood, etc) area to help you along your home buying journey, please call or text Becky Crockett at (480) 467-9268 or email becky@vizualifeaz.com

Opinions are my own and not the views of eXp Realty.

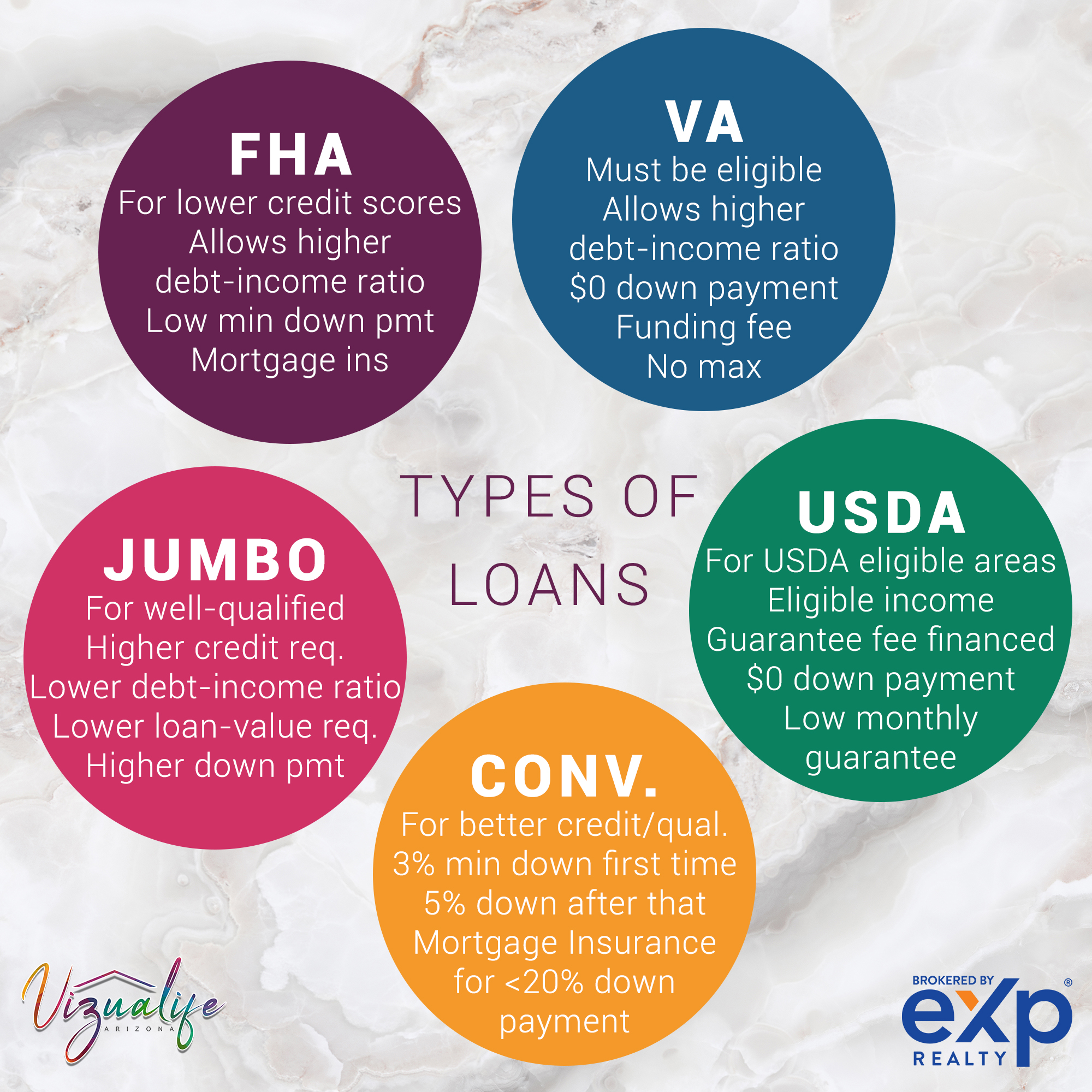

The government has created programs to help first-time homebuyers be able to afford homeownership.

FHA Loans: Minimum down payment of 3.5%. Mortgage insurance is required (an extra fee as insurance in case you can’t continue to pay your mortgage). The requirements for credit scores and debt-to-income ratio are not as stringent.

VA Loans: You must be eligible for VA loans by being a military veteran and other specific requirements regarding time in service, etc. VA loans do not require a down payment, but they do have a funding fee. They also allow higher debt-to-income ratios.

USDA Loans: Only available in certain urban areas and for those under certain income levels. It is also a zero-down loan and generally has lower monthly payments.

Conventional and Jumbo Loans are traditional methods of obtaining a mortgage and are generally better for those selling a previous home or with a generous amount of savings to put toward a down payment, and with more solid credit history.

Conventional Loans: These can be used for first-time homebuyers and only require a 3% down payment for first-time homebuyers, and 5% down payment after that. However, mortgage insurance will be charged if anything less than 20% down payment is made.

Jumbo Loans: These are for people who are well-qualified since the credit, debt-to-income, and loan-to-value ratios are must more stringent. Higher down payments are also required.